2021 was arguably the Year of the Layer-1’s, with ecosystems like Solana, Avalanche, and Terra taking a significant chunk of Ethereum’s market share.

In the latter months of 2021 and early 2022, lesser-discussed ecosystems like NEAR, Cosmos, and Harmony have paved their way into the discourse.

Each of these top L-1’s brings something different to the table, along with sizeable ecosystems and communities. Harmony is no different.

With its impressive team, interesting roadmap, promising tech, and formidable ecosystem funding, Harmony may very well outperform the crypto market in the coming months or years.

Before we dive off the deep end, a quick explainer is in order.

This is a lengthy email, so you’ll need to hop over to my Substack page to read the entire thing. That link should be somewhere in the email (you’ll have to excuse me, I’m a bit new to this platform).

I’d love to crank up the cadence of long-form content like this, but I’ll need your help with that. If we can reach 200 subscribers, that should be enough to justify two long-form articles per month. At no extra charge to paid subscribers, of course.

And please show some love to the co-author, Bradley Stone (author of Crypto Brew). We’ll be tag-teaming newsletters in the future, so subscribing to the Brew is indirectly supporting Alpha Trades as well.

Now back to your regularly scheduled programming.

Investor Summary

Definition: Harmony is an EVM-compatible cross-chain smart contract platform

Funding Rounds, Investors, and token allocation: See Tokenomics.

Sector: Smart Contract Platforms

Market capitalization: $2.16B (Messari) or $2.2B (Footprint Analytics) | +10Y Market Cap: $3.30B (Messari)

Token: $ONE | Consensus Algorithm: Effective Proof-of-Stake (EPOS) + Fast BFT enhanced by Synchronous View Change | Best liquidity: Binance.US

Total staked: 38% | Validator Annual Percentage Rate (APR): 9.91% | Delegator APR: 9.13% (StakingRewards.com)

Token circulating supply: 11.68B | Total Supply: 13.15B (Harmony Analytics) | Max supply: Infinity, with the potential to reach net neutral inflation.

Distance from All-Time High (ATH): -50.83% | ROI vs. USD from the past year: +2038% (Messari)

Audits | History of exploits: November 2020 browser wallet extension hack | Whitepaper

What is Harmony Protocol?

Harmony was founded in 2018 by Stephen Tse, a former Google and Apple software engineer. Harmony’s mainnet went live in June 2019 with full EVM compatibility and has thus far produced 450k+ transactions in its native $ONE tokens.

Harmony’s unique architecture allows for building scalable, decentralized, secure, and privacy-enhanced dApps that can be bridged to other blockchains. That’s the tagline for every layer-1 out there, but I’ll unpack the finer details in this report.

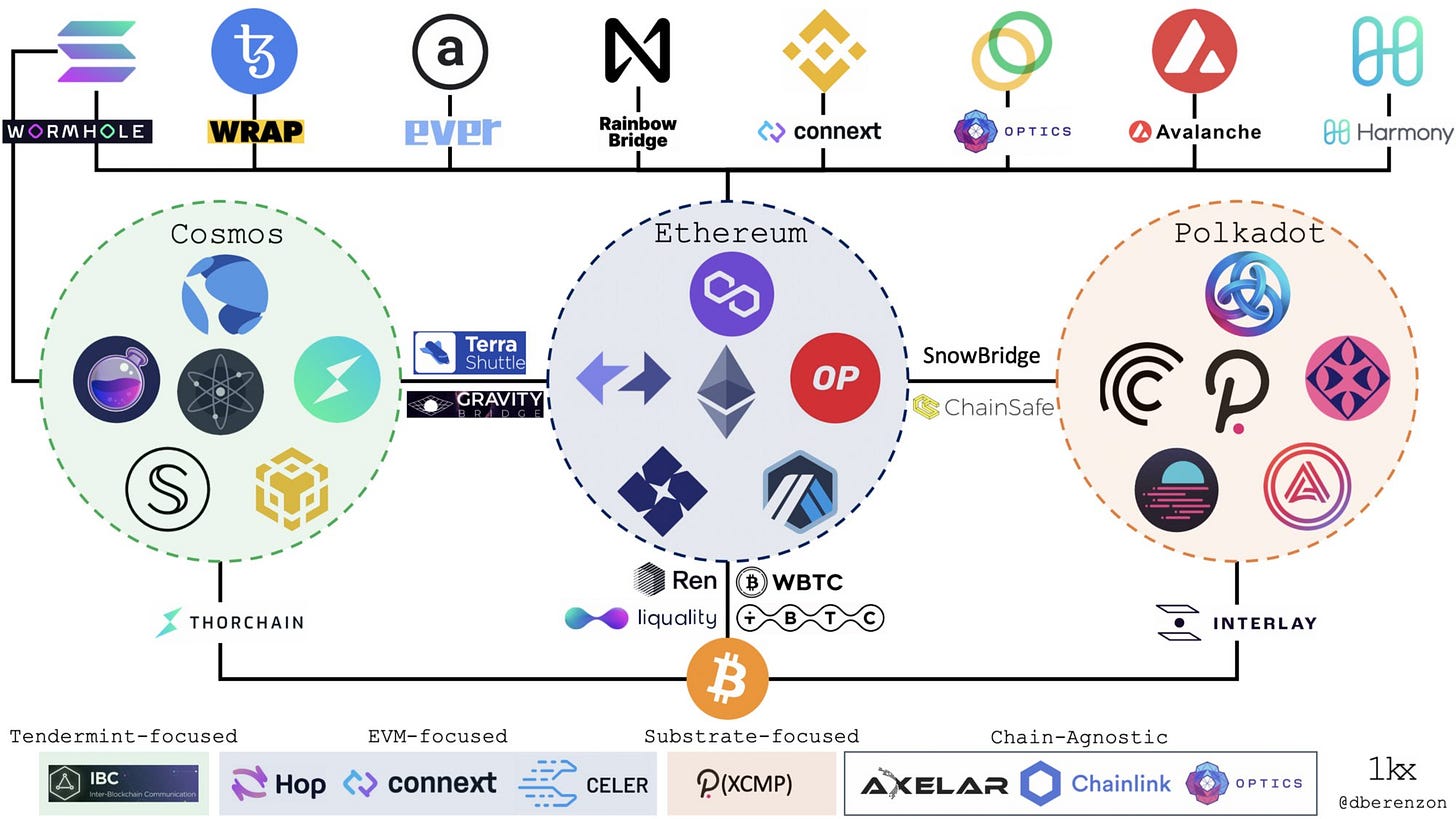

Harmony’s increased adoption is largely driven by its interoperability with other smart contract blockchains. That started with the Horizon Bridge, which became compatible with the Binance Smart Chain in late March 2021.

Harmony is also EVM compatible, and its cross-chain bridge is fully interoperable with Ethereum and saw a 7-day TVL change of 37% as of January 17. The Harmony bridge has a solid safety and uptime track record, along with being trustless and gas-efficient.

Most of the HRC-20 tokens on Harmony are native to the Binance Smart Chain. Also, the $ONE token launched via the Binance Launchpad, hinting that Binance has a stake in the project’s success.

The Tech

Unlike many Layer-1 projects on the market, Harmony was built from the ground up and is not a fork of any other blockchain. Harmony is often considered a nearly finished version of what Ethereum 2.0 aims to become. That’s because Harmony implements sharding, which entails splitting a single blockchain into multiple segments called “shards.” Harmony currently has four shards, starting with the beacon chain (shard 0).

Each shard can process up to 1,000 transactions per second (TPS), cumulatively reaching up to 4000 TPS. Transaction finality within and between shards are roughly the same, clocking in at around two seconds.

To secure the shards, Harmony uses “Effective Proof-of-Stake” (EPoS). That entails randomly assigning validators to a single shard (up to 250 validators each) and reducing the staking rewards if the stake becomes too large. That makes sure no single validator grows large enough to compromise a shard.1

According to the whitepaper, this approach to sharding allows Harmony to scale linearly without compromising security.

Harmony also uses slashing for double-signing and unavailability during selection to keep validator behavior in check, but it does not slash for downtime.

The protocol has relatively low barriers to entry for validators, requiring 10,000 $ONE to run a validator node and 1000 $ONE to delegate. Annual returns for running a validator and delegating are around 10%.

$ONE is used for governance and to pay transaction (gas) fees on Harmony, and these fees typically cost around $0.000001.

Only validators can table proposals to change the Harmony network, while both validators and delegators are able to vote. Over 2/3 of all $ONE staked must vote in favor for a proposal to pass.

In other words, transacting on Harmony is very cheap. On top of that, all $ONE used to pay for transaction fees is burned.

Currently, Harmony hosts about 62 decentralized applications (dApps), the largest of which is DeFi Kingdoms. More on that later.

Harmony’s ONE Wallet browser extension is the core dApp for interacting with the various dApps in the Harmony ecosystem and delegating $ONE to validators.

$ONE can be stored on a wide variety of wallets and traded on several major crypto exchanges.

Tokenomics

Genesis supply of the $ONE token: 12.6B

Allocation:

22.4% to private investors of the 2018 seed sale (at roughly $0.005 per token)

12.5% sold via a Binance Launchpad IEO (roughly 1/3 of $0.01 per token)

The remainder was allocated to the Harmony team.

Allocated $ONE tokens are subject to different vesting schedules ranging from 2 to 4 years.

📢 Recent Updates (2021-2022)

July 7, 2021 — Terra and Harmony announce a DeFi partnership focused on $UST stablecoin integration. The partnership features a Terra-Harmony bridge via Shuttle Bridge and the ONEAnchor Savings Product.

April 7, 2021 — Sushi joins Harmony, planning to bring its full suite of products to the Harmony network.

April 21, 2021 — Harmony integrates with Injective.

March 5, 2021 — Harmony releases its all-in-one governance dashboard, streamlining the governance process.

May 7, 2021 — Harmony launches ValidatorDAO, dedicating 4M $ONE tokens seeded in eight installments over eight months. The DAO comprises five community-elected validators that will vote on subjects such as lock-up periods and staking minimums.

May 2021 — OIN Finance partnership announcing the development of a $ONE-backed stablecoin

June 11, 2021 — Harmony launches the Community DAO, primarily serving to market and advocate for the Harmony ecosystem. The DAO receives fees from the Crazy.one subdomain portal to fund its activities.

June 24, 2021 — Full-stack partnership with SushiSwap, along with $4M worth of incentives.

September 9, 2021 — Harmony launched a $300M Developer Incentive Program to accelerate 10,000 builders.

September 13, 2021 — Polygon Bridge is live via Anyswap, bringing wrapped $BTC to Harmony.

October 2021 — Harmony hosts its ONE World conference in Lisbon, Portugal. The event attracted an impressive turnout. An equally significant conference followed that in December.

October 2021 — Curve Finance launches on Harmony, boosting TVL for the network and rewards for many participants.

December 14, 2021 — Chainlink price feeds are available on Harmony mainnet.

January 24, 2022 — Ledger announces support for Harmony on Nano X.

📈 Analysis

The Harmony ecosystem has grown rapidly this year. Below are some interesting stats:

Total native HRC-20 tokens on Harmony: ~1267

Downloads of the ONE Wallet browser extension: 190k wallets-,190k%20wallets,-%248.5m%20payout%20for)

Total dApps on Harmony: 62 (227 apps, according to the Harmony website)

Total NFT sales on Harmony’s daVinci marketplace: $1.06M (supporting 7,480+ artists)

$8.5M+ payout to 27 approved grant proposals

$5M+ payout to 110 Gitcoin bounties.

Most of the initial supply of $ONE is currently in circulation, while over 40% is being staked.

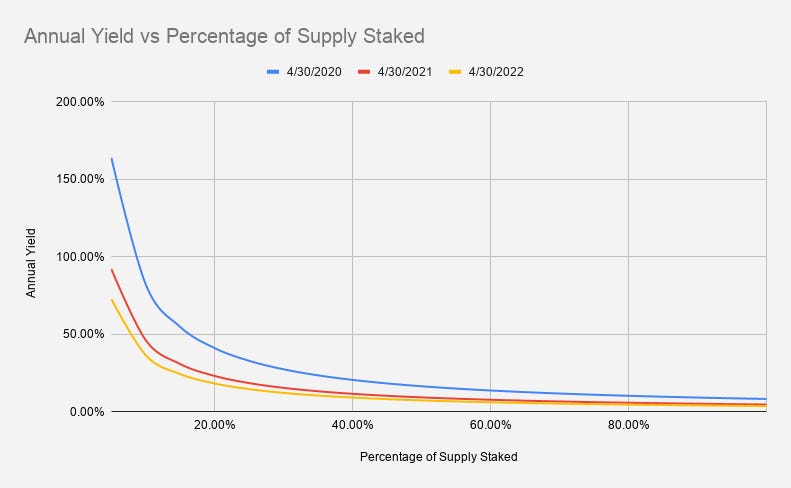

Harmony often emphasizes its value proposition to validators and delegators, referring to the Harmony Economics Model, which states a cap on the annual issuance of $ONE tokens at 441M (about 3% inflation). In theory, the model provides predictable returns over the long run for stakers while potentially leading to neutral inflation if the network usage rises enough.

Important note: $ONE will never be deflationary because fee burns only offset newly issued $ONE, not any $ONE from the existing supply. This ensures that validators and delegators are incentivized to stake when traffic is low, via new token issuance, and when traffic is high, via fees.

Harmony is utilizing liquidity incentives to kick its expansion into hyperdrive and also has significant funds set aside for outright acquiring bridge tech companies.

Harmony also dedicated significant capital ($300M) to an ecosystem fund. Starting in September 2021, the fund has supported multiple projects in the DeFi, infrastructure, gaming, and NFT categories.

So far, the new fund has assisted 23 DAOs in launching on the network, with more currently in development. The fund is likely designed for Harmony to become a thoroughly decentralized network to get ahead of regulators and increase its chances of being listed on Coinbase.

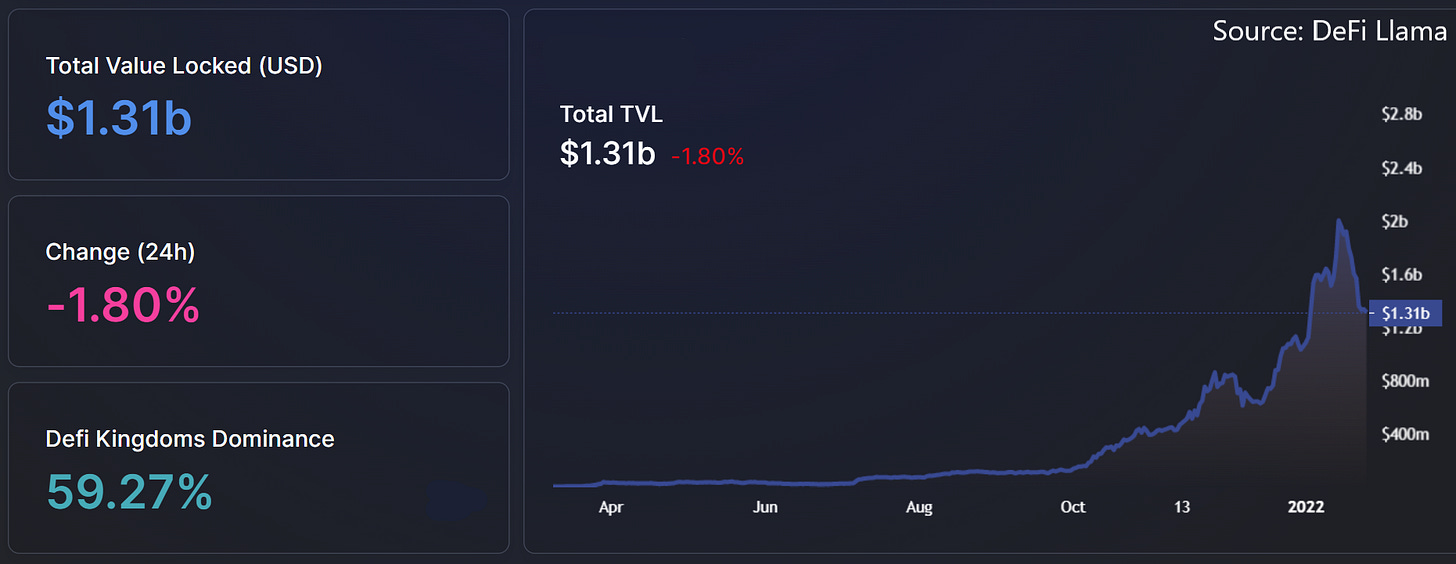

Pending the current bearish posture of macro and crypto markets, TVL on Harmony is on track to continue a positive uptrend. As of this writing, Harmony’s total TVL is at around $1.17B. DeFi Kingdoms ($JEWEL) currently dominates TVL on the Harmony network, accounting for $646M, or over 50% of Harmony’s total TVL. Again, that number has recently fallen from mid-$700M levels due to current market conditions.

The success of these liquidity programs may be partially reflected in Harmony’s continuous rise of active addresses:

While there are dozens of projects on Harmony, most of these are nearly carbon copies of existing DEXs and similar projects. More promising activity centers around the Harmony NFT ecosystem, such as the DaVinci NFT marketplace and the Crazy.one “subdomain” NFT website (similar to Unstoppable Domains).

The neat thing about Crazy.one is that all tokens used to pay registration fees go to a DAO-controlled treasury.

I’m a fan of protocol-aligned initiatives, so it’ll be interesting to see how subdomains pan out for the Harmony ecosystem.

When you combine the impressive Résumés of the Harmony core team with the impressive and nuanced ecosystem fund and how well the funds have been managed thus far, Harmony’s future certainly looks bright.

On the flip side, funding for that comes from sales of the $ONE token, putting downward pressure on price.

🗺️ Roadmap & Rumors

Harmony has a multifaceted roadmap with dozens of projects in variable stages. What stands out the most are Harmony’s measurable goalposts and their transparency in how they’re working toward achieving each of the following:

100 DAOs deployed on Harmony with significant support and tooling

One million 1Wallet users

10,000 new developers

To explore Harmony’s full roadmap and discover how far along they are with these goals, head to open.harmony.one/strategy-roadmap

Below are a few interesting developments and markers on the roadmap:

July 29, 2021 — Two of Harmony’s prominent researchers released a paper exploring how staking rewards may be a viable solution to universal basic income (UBI). The paper focuses on Terra’s Anchor protocol, which offers a fixed 20% interest rate. The researchers believe it should be possible to use a decentralized algorithmic stablecoin to improve Anchor’s technology.

Aave integration is set to go live any day now.

Bitcoin Bridge is allegedly coming to Harmony in early February 2022.

Cosmos Bridge — Grant approved, and development is well underway.

Terra and Polkadot bridges — In testnet phase.

Staking derivatives — Under development.

MetaMask staking — Executing, though Metamask integration is already complete.

1-second finality — In development.

The Harmony 1Wallet (separate from the browser extension) is designed to be the centerpiece of the Harmony ecosystem. Harmony’s roadmap states the mobile wallet will have multiple features: Stable APY on stablecoins, DeFi access, NFT support, novel security features (social recovery), bank transfers, and payments.

Concerns and Concluding Thoughts

Harmony is powered by a growing and dedicated collective of DAOs powered by a substantial ecosystem fund that already backs several talented teams.

Considering Harmony’s activity in the NFT sector and its technological advantages compared to its competitors like Ethereum, along with some impressive marketing efforts, we may very well see Harmony explode onto the scene in the coming months.

With all of that considered, it is no surprise that the price and TVL rose significantly since January 2021. I think this project has the potential to outlast an upcoming bear market.

One concern in the short term for the price of the $ONE token is that $ONE’s supply is still vesting. This may be suppressing price action at a time when macro and crypto markets are experiencing downside turbulence.

The recent vesting cliffs likely led to tokens being sold, pressing down the price. There is only one vesting cliff left in November 2022, while the remaining ~$200M in Harmony’s ecosystem fund will likely be spent over a longer period.

Harmony also suffered from a network outage for about 14 hours between January 12 and 14, 2022. This was due to heavy spam traffic on the network, and the team has since released a transparent post mortem. I believe the team's transparency has improved vastly from the early months following Harmony’s launch.

Besides, Harmony should be given some slack about the outage since even darlings Ethereum, Solana, Arbitrum, and OpenSea have suffered from outages in the past year.

Further reading

Interested in going deeper down the rabbit hole?

Harmony: ONE Update!! My Take On Its POTENTIAL!! 🧐 - Coin Bureau

Harmony: ONE To Watch!! Price Potential?! 🤔 - Coin Bureau

Harmony’s extensive documentation and user guides: docs.harmony.one/home

Harmony Protocol Review: Enabling Decentralisation at Scale - Coin Bureau

Harmony Socials:

YouTube · Instagram · Twitter · Wechat · Telegram

Discord · Medium · LinkedIn · Facebook · Reddit

Enjoying all the alpha? Make sure to hit the button below.

🧠 Disclaimer: We are not financial advisors, and this article is meant to be an educational complement to your own research. The Alpha Trades team has no stake in Harmony $ONE as of this publication but may enter or initiate a position within the next six months. Nothing herein is financial advice. All contents in this article should be considered from the date the article is published, as market conditions are subject to change.

Note that the max number of nodes/validators is not the same as the max amount of “slots” available across all shards. A single node can occupy multiple slots, depending on the size of the stake. Slots are bid on by validators using BLS keys.

It appears there are currently around 660 validators occupying about 900 “external” slots, with the remaining 100 occupied by internal (Harmony Foundation) nodes.

Harmony is working on fully decentralizing its nodes, eliminating internal nodes, and replacing them with fully external ones. That proposal can be found here.

If that sounds confusing, it’s because it is. You can explore the finer details about how slots are currently occupied here: shardstats.dkvalidator.one

As a side note, there are roughly 26,300 unique delegates on Harmony.