Stargate Finance – A Bridge to the Omnichain Future?

Alpha Trades explores what the first project built on LayerZero brings to the table.

With crypto markets reeling on the macro, some of even the most ambitious projects have taken a hit.

That means the Alpha Trades community has time to pick up some interesting assets at a steep discount. One such project we’ve examined is Stargate Finance ($STG).

Stargate Finance attracted over $1.9 billion Total Value Locked (TVL) in less than a week following a big investment from Alameda Research and reached $4.17B in April.

With Stargate enjoying some time in the Crypto-Twitter limelight, the folks at Alpha Trades decided it was time to dig deeper.

Table of Contents

Investor Summary

What is Stargate Finance?

Stargate Team and History

Tokenomics and Governance

Partnerships and Recent Updates

Analysis and Concerns

Further reading

Investor Summary

Definition: Stargate Finance is a fully composable liquidity bridge built on LayerZero Protocol. Stargate’s unique approach to bridging simplifies the process and opens new opportunities for developers and users.

Funding Rounds, Investors, and token allocation: See Tokenomics

Sector: Cross-Chain

Token: $STG | Available on Uniswap (v3), TraderJoe, and several crypto-supporting exchanges. Best liquidity: FTX

DeFi TVL: $1.43B (DeFiLlama)

Max & Total Supply: 1,000,000,000 (1 billion)

What is Stargate Finance?

Stargate is a cross-chain bridge that aims to solve the “Bridging Trilemma” by using community-owned unified liquidity pools between chains, an instantly-guaranteed transaction finality, and utilizing native assets for cross-chain swaps.

Via its Delta Bridge, Stargate will allow any user to transfer assets from one blockchain to another one in a single transaction. This system removes the need for complex methods like locking, minting, burning, and redeeming assets. (Source: Cointelegraph)

Like AnySwap and THORChain, Stargate doesn’t require an intermediary consensus layer. To understand how that is possible, we must first explore the cross-chain protocol that Stargate is built upon, LayerZero.

LayerZero – The Omnichain Protocol

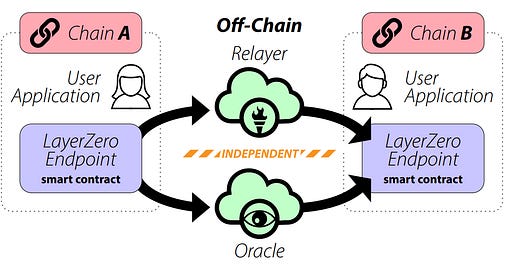

The LayerZero whitepaper details how the underlying technology of Stargate works at the protocol level, but here I’ll share a simplified diagram:

LayerZero uses a relayer or native authentication system with ChainLink as its oracle. The relayer and the oracle operate independently, and the two mustn’t collude to ensure the protocol’s security. Thus Stargate chose ChainLink for the oracle’s long-standing dependability.

The relayer scheme is utilized by several major protocols, including Near’s Rainbow Bridge, Avalanche’s Avalanche Bridge, and Terra’s Terra Bridge. The Cosmos IBC also utilizes a relayer system, a strong example of a comparative transport layer within a “Layer-0” ecosystem.

Relayer-based protocols serve a similar role as the TCP protocol of today’s internet, but with some key differences. Unlike the Web 1.0 and Web 2.0 internet, protocols like LayerZero offer a suite of decentralized methods for transmitting data and building blockchain-based applications like dApps.

Using LayerZero, Stargate claims to be the first bridge to solve the Bridging Trilemma by implementing the following successfully:

Instant Guaranteed Finality means users can trust that successfully committed transactions on the source chain will arrive on the destination chain.

Native Asset Swaps on Stargate don’t require extra swaps to acquire the desired asset. It’s cheaper, faster, and has fewer potential points of failure.

Unified Liquidity pools across multiple chains mean deeper liquidity. When combining the above features, impermanent loss becomes a non-issue on Stargate.

Based on the features above, Stargate has at least two compelling use-cases:

A decentralized exchange (DEX) can use Stargate to complete single transaction cross-chain swaps (such as swapping $AVAX for $ETH), all from the same DEX’s interface.

A yield aggregator can use Stargate to deploy assets cross-chain, unlocking new yield generating opportunities.

The Delta Bridge

Stargate utilizes LayerZero to connect funding liquidity across all blockchains within the system.

Such a setup can significantly improve capital efficiency for connected chains. Users can provide liquidity on one chain, and Chainlink will dynamically allocate that liquidity across other chains with instantly guaranteed finality and by using native blockchain assets.

“Native assets reduce the surface of attack vs. traditional bridges by orders of magnitude and offer the ideal end-user experience both at the application and consumer levels,” LayerZero Labs CEO Bryan Pellegrino told The Block.

Stargate claims it can do all of the above via its Delta Bridge. You can find a much more in-depth explanation of LayerZero, Stargate, and the Delta Bridge in this article by Hackernoon.

Stargate Team and History

Stargate originated from the Vancouver-based company LayerZero Labs, whose team continues to support the development of the LayerZero protocol and the dApps built on top of it, such as Stargate.

The LayerZero team recently announced they’d hired Maki, a co-founder of SushiSwap ($SUSHI), to lead business development at Stargate. Click here to read more about what makes SushiSwap interesting.

What makes bridges so important?

Bridges like Stargate have drastically increased composability between disparate chains.

Composability in Web3 is the ability of the various dApps and infrastructure to interoperate. A high level of composability is necessary for a vast network of distributed participants to cooperate and build new Web3 applications.

Over time, the sea of disconnected communities in Web3 have converged upon standards that describe how certain kinds of contract should behave. The Ethereum network’s ERC-20 token standard is a shining example of the community standards that have made composability possible.

These standards are akin to the Internet’s TCP protocol mentioned earlier, allowing various applications to plug into each other easily.

In Web3, such composability enables impressive innovations at scale, like DeFi and cross-chain bridges.

With over $26B TVL in bridges across all blockchain ecosystems (and that’s during a bear market), it’s quite apparent that bridges have proven their case as a critical component of Web3 composability.

Like real-world bridges, bridges facilitate communication between chains through the transfer of information and assets in the blockchain world. Bridges enable much more liquidity between disparate blockchain ecosystems, making the entire blockchain industry more interoperable. Many chains are pivoting to becoming more modular and adopting bridging tech to solve different chains' variable rules and consensus mechanisms.

Bridges enable dApps to access the strengths of different chains, enhancing their capabilities. In a nutshell, bridges enable greater innovation and collaboration in the blockchain space.

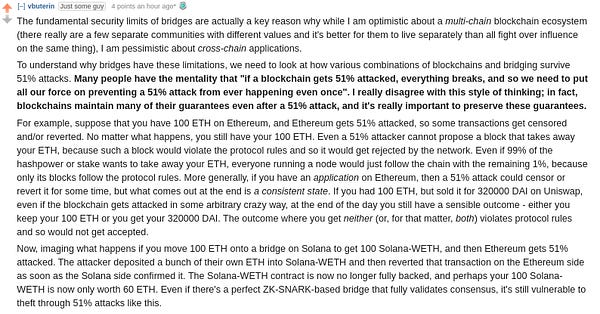

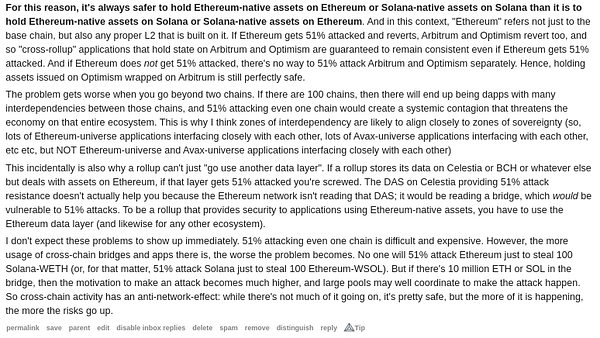

Many readers are understandably cynical of bridges, citing recent exploits by hackers that made this tweet from Vitalik appear prophetic:

If Vitalik’s POV has some degree of truth, multi-chain bridges will also be significantly more secure than cross-chain bridges. Still, the momentum behind cross-chain bridge use and development suggests the tech is here to stay and is likely to improve in the future.

Tokenomics and Governance

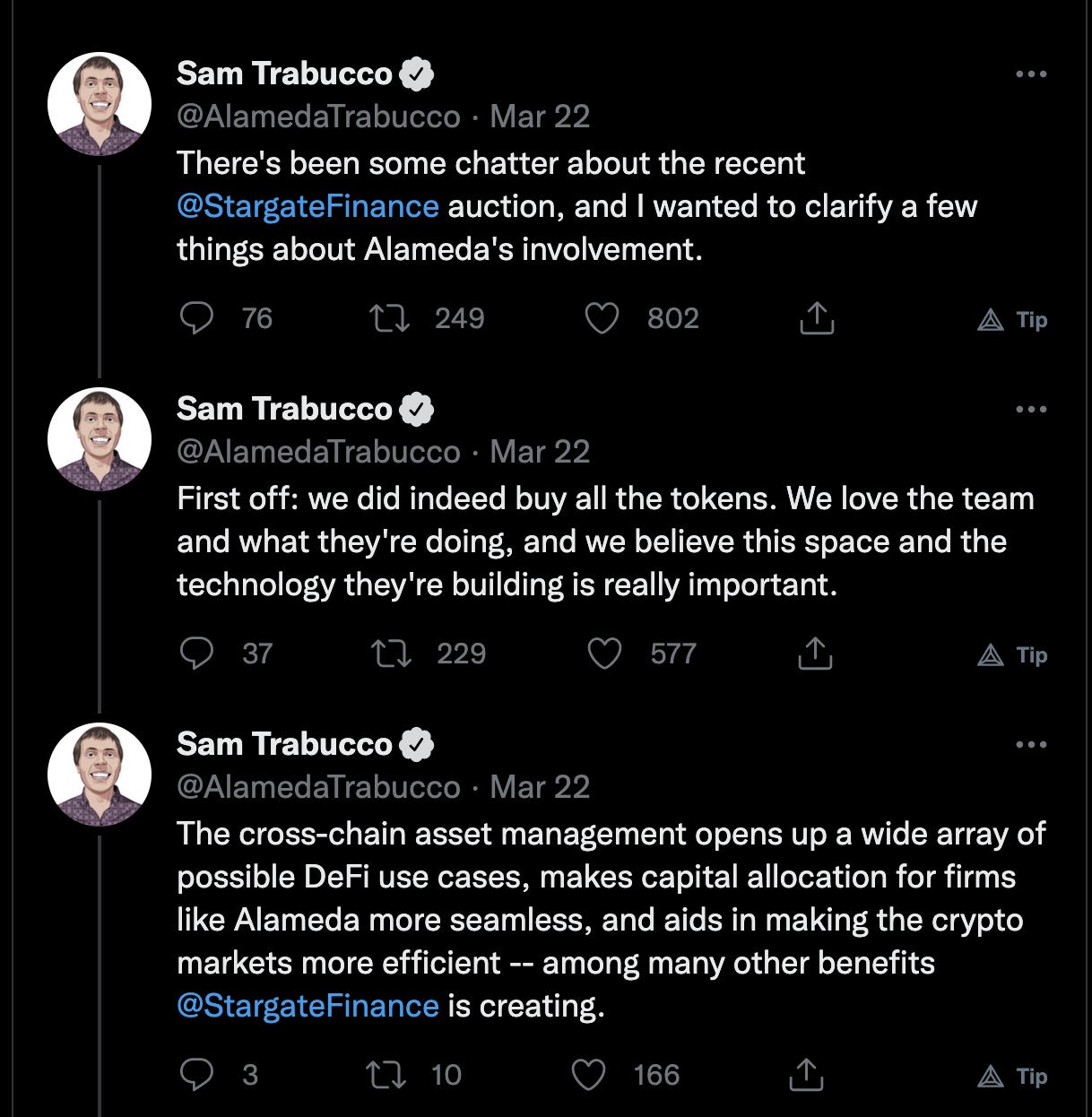

The entire 1 billion supply of $STG was minted at genesis, and a community auction for $STG began on March 30, 2022. The auction was directed towards generating liquidity across the seven blockchains that participated in Stargate’s launch, and the auctioned amount equates to 10% of the total supply of $STG (100 million tokens).

Some of the early investors obtained $STG tokens at $0.25, but pressure for these individuals to cash out is temporarily muted, thanks to variable lock-up schedules.

See the full tokenomics breakdown here.

Stargate also comes with staking opportunities for $STG holders. By staking their $STG tokens, holders can receive additional veSTG, Stargate’s governance token. Staking may come with extra network security, less volatility during sell-off events, and the potential for staking derivatives.

Stargate uses time-weighted voting to provide long-term Stargate token holders greater governance weight and control of the Stargate protocol. That means there is an incentive for keeping $STG staked for longer time periods.

Governance token holders (Stargate DAO and the Stargate Foundation) direct the project’s major decisions, but the ultimate execution must come from a multisig of trusted community members.

📢 Partnerships and Recent Updates

Networks partnered with Stargate include Ethereum ($ETH), BNB Smart Chain ($BSC), Polygon ($MATIC), Avalanche ($AVAX), Arbitrum, Optimism, and Fantom ($FTM).

The LayerZero team plans to add support for more chains, including Solana ($SOL), Terra ($LUNA), and Cosmos ($ATOM).

In addition, a proposal by Maki to integrate SushiSwap with Stargate passed with over a 95% approval ratio. That’s not surprising, given Maki’s association with both projects.

📈 Analysis and Concerns

Stargate liquidity providers (LPs) can farm their LP tokens to earn $STG rewards. The project is sustaining attractive stablecoin farming yields across its supported networks, attracting enough capital to place this young project in the top 10 largest DeFi protocols by TVL.

Delta Bridge’s mechanisms and early-stage $STG subsidies allowed some lucrative stablecoin farming schemes. DeFi users rushed into Stargate to take advantage of ~20% APYs on stablecoin farms, and these numbers have since come down to the ~5-8% range.

According to the excellent write-up from @crosschaingeek, a big part of the reason for the APY drop is that early subsidies are running out. Nearly 100% of the mining rewards relied on the subsidy.

The initial flux of users were primarily DeFi yield farmers using the “deposit” feature to mine for the juiced rewards rather than users utilizing the “swap” feature. The latter would signal a demand for Stargate’s cross-chain liquidity bridge, but unfortunately, we’ve not seen such a signal.

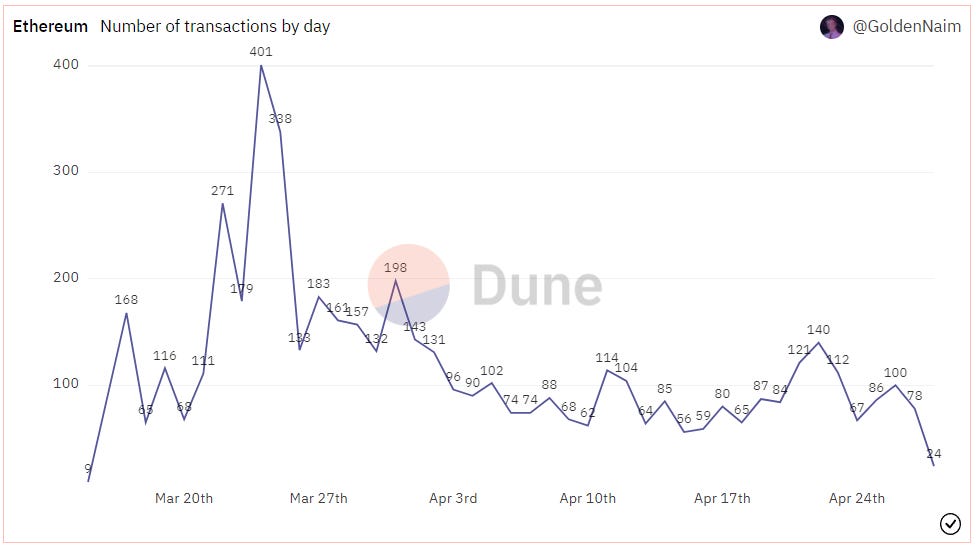

Stargate has not managed to keep enough users around to prop up the APYs, so in a negative feedback loop, activity on Stargate has cooled off significantly.

That is somewhat troubling for the protocol, as the total transaction count was never that high to begin with when compared to other bridges in the market.

However, despite the lower apparent usage, Stargate continues to gain users by at least one Dune Analytics source:

🚨The Cobo blockchain security team discovered Stargate and LayerZero recently patched major security vulnerabilities at the underlying protocol level.

While the actual issues discovered are too technical to unpack here, it’s worth being cautious over bridges and protocols that use a relayer scheme, like the Cosmos IBC.

Simplicity at face value (in other words, in the marketing materials) does not always equate to more security. Readers must be cautious when using any cross-chain bridge, as hacks exploiting vulnerabilities in the code can and often do happen. That has already been the case with bridges that use a Multi-signature notary, such as Axie Infinity’s Ronin bridge, Multichain, O3 Swap, and Wormhole.

By comparison, bridges that use atomic swaps to implement hash time lock contracts (HTLC) may have fewer vulnerabilities, as mentioned by @crosschaingeek.

Further reading

Website: https://stargate.finance

Twitter: https://twitter.com/StargateFinance

Telegram: https://t.me/joinchat/LEM0ELklmO1kODdh

Discord: https://stargate.finance/discord

Medium: https://medium.com/stargate-official

A Farewell to Bridges | Stargate Finance Blog

Enjoying all the alpha? Make sure to hit the button below.

🧠 Disclaimer: We (The Alpha Trades team) are not financial advisors, and this article is meant to be an educational complement to your own research. The Alpha Trades team has a small stake in Stargate Finance ($STG) as of this publication. Nothing herein is financial advice.